Do you have trouble saving money?

Are you looking for a safe and secure starter account for you or for your kids?

For those of you who may already have a Wells Fargo checking account, or are looking to make the switch – adding Way2Save savings to your account portfolio may be a good way for you to stash away anything extra and learn how to save money.

What Is A Wells Fargo Way2Save Savings Account ?

Way2Save is a savings account offered by Wells Fargo Bank. You can open the account with or without an accompanying checking account. But, while the account does provide all the features of a savings account and a variable interest rate, in order to utilize one of the automatic transfer options you must have a linked Wells Fargo checking account.

This account works mostly like a “piggy bank” and helps you build up your savings as quickly or as slowly as you would like.

Here are the current variable rates for a Way2Save account:

Variable rate (compounded daily)

| Balance | Interest Rate | APY |

|---|---|---|

| $0 or more | 0.01% | 0.01% |

Compare Wells Fargo Account Rates

The Way2Save account also offers 2 plans to help you build up your savings:

| Way2Save Savings Options | Explanation |

| Save As You Go | $1 of your funds from your linked Wells Fargo checking account will be transferred to your Way2Save Savings account each time you:

As an example in this scenario, if you make 15 qualifying transactions each month — that adds up to $180/ year in savings!

|

| Automatic Transfers | You can set up daily or monthly automatic transfers from your checking account into your Way2Save account.

*Wells Fargo will not initiate the automatic transfer if completing it would cause your checking account to be overdrawn. The next scheduled automatic transfer or Save As You Go transfer would occur as long as there are adequate funds in the checking account for the transfer.

|

Can I set up more than one method of automatic savings?

Yes. You can choose one or more automatic savings options for your Way2Save Savings account. This includes daily, monthly and Save As You Go transfers.

How Can I Deposit and Withdraw Money from a Way2Save Savings Account?

Wells Fargo operates via branches and online, making it easy to manage your money:

Deposits

- Direct deposits

- At branches or ATMs

- Online transfers

- Mobile check deposit

- Send a check via mail

- Wire transfers

Withdrawals

- At branches or ATMs

- Online transfer

- Addressing a check to another one of your accounts

- Wire transfers

What are the Account Fees for A Wells Fargo Way2Save Savings Account?

Way2Save requires a minimum opening deposit of $25 and a monthly service fee of $5. You can avoid the monthly service fee if you:

- Maintain a $300 minimum daily balance, or

- Set up and maintain one or more automatic, recurring savings options

- Are under the age of 18 (19 in AL) and are the primary owner of the account

Here is the current fee schedule for Wells Fargo Way2Save Savings Accounts:

| Type | Fee |

| Monthly Service Fee | $5

*can be waived if you meet one or more of the savings criteria. |

| Minimum Opening Deposit | $25 |

| Account Research Fee | $25/hour |

| Wells Fargo ATM Transactions/ Inquiries | $0 |

| Non-Wells Fargo ATM Transaction | $2.50 each |

| Non-Wells Fargo ATM Balance Inquiry | $2 per inquiry |

| Non-Wells Fargo ATM Transfer | $2 per transfer |

| Non-Wells Fargo ATM International Transaction | $5 each |

| ATM statement | $1 per statement |

| International purchase transaction fee | 3% of transaction amount |

| Debit card over-the-counter cash disbursement at non-Wells Fargo Bank location | $3 per teller transaction (international is 3% of transaction amount) |

| Cashier’s Checks | $10 each |

| Online document copies | $0 |

| Document/ Paper copies requested at branch or over phone | $5 per item

*Charged to your account monthly. |

| Excessive withdrawals (more than 6 per billing cycle) | $15 per withdrawal transfer.

*MAX 3 excessive activity fees per monthly billing cycle |

| Overdraft and returned items | $35 each |

| Cashed/ deposited item returned unpaid | $12 per item |

| Overdraft protection from eligible savings account | $12.50/transfer |

| Incoming domestic wire transfer | $15/ transfer |

| Incoming international wire | $16/ transfer |

| Outgoing domestic wire | $30 each |

| Repetitive outgoing domestic wire | $25 each |

| Outgoing international wire | Fee disclosed at time of transaction |

What Are The Benefits of A Wells Fargo Way2Save Savings Account?

- Wells Fargo has 13,000 free ATMs and about 5,700 branches as well as mobile and online banking available for you to be able to easily access your money.

- FDIC-Insured

- Free ATM card

- Avoidable monthly fee

- Way2Save account can be used for overdraft protection on your checking account

- Earn interest on any balance

- Automatic monthly or daily transfers

- Save As You Go transfers

What Are The Disadvantages of A Wells Fargo Way2Save Savings Account?

- Monthly service fee

- Minimum opening deposit is $25

- 0.01% APY on standard savings account; better rates available elsewhere

- Limit of (6) withdrawals per billing cycle

- You’ll need Wells Fargo checking to be able to use the auto transfer and save as you go features

- Wells Fargo has high out-of-network ATM fees, foreign transaction fees and wire transfer fees

The APY that Wells Fargo offers for their Way2Save program is lower than the national average of 0.10%…. so your money will only grow so much while its sitting in your account. Switching to an online bank may help you gain a larger return on your investment.

As of November 2022, here are some rates from competitors that you may want to check out:

- Aspiration Bank – 3.00% APY

- TAB Bank – 3.00% APY

- Citi Accelerate – 3.10% APY

- First Foundation Bank Online Savings – 3.60% APY

- Barclays Bank – 3.00% APY

- CIBC Bank – 3.27% APY

- Goldman Sachs – Marcus Account – 3.00% APY

- Synchrony Bank – 3.00% APY

- TIAA Bank – 0.80% APY

- Ally Bank – 0.75% APY

- Citizens Access – 0.75% APY

- Capital One 360 Performance Savings – 0.70% APY

- Discover – 0.70% APY

- American Express Personal Savings – 0.65% APY

- CIT Bank Savings Builder – 3.25% APY

- MySavingsDirect – 0.50% APY

- Vio Bank – 0.50% APY

- HSBC Direct – 0.05% APY

Is A Wells Fargo Way2Save Savings Account FDIC-Insured?

Yes. Wells Fargo Bank is a FDIC member, which means that funds deposited in a Wells Fargo Way2Save Savings are insured up to the maximum allowed by law.

The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation providing deposit insurance to depositors in U.S. commercial banks and savings institutions. The FDIC insures deposits according to ownership category (such as individual, joint or accounts with beneficiaries). The current maximum amount is $250,000 per depositor, per insured bank, for each account ownership category...

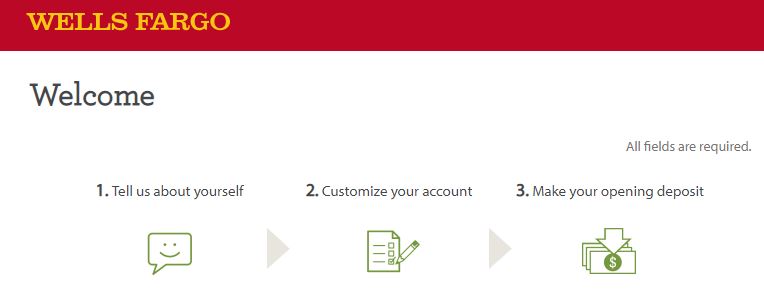

How Do You Open A Wells Fargo Way2Save Savings Account?

You can open a Way2Save account by making an appointment at a local branch or by applying online.

How to apply for a Way2Save account online:

What you’ll need to apply

- Social Security number (or ITIN)

- Valid ID (driver’s license, state ID, Matricula card)

- $25 opening deposit online – it’s easy to transfer from another account (new customers: have a check handy) or use your debit or credit card

Once you have that,

- Visit the Wells Fargo website, hover over Banking and cards, then click Savings accounts and CDs.

- Scroll down until you see Way2Save Savings and click Open account.

- Choose between an individual or joint account, and indicate whether you are a current Wells Fargo Online Banking customer or not.

- Fill in your personal information, employment details and all other fields, then continue.

- Choose your savings account options.

- Decide how to fund your account or select fund later.

- Review all details and submit your application if you agree to the terms…

How To Access Your Wells Fargo Way2Save Savings Account:

Online: Access your account by logging in with your username and password on: WellsFargo.com

Mobile Device: Bank on your phone/tablet through their mobile app.

How To Contact Wells Fargo About your Account:

Wells Fargo Online

- Visit wellsfargo.com or call 1-800-956-4442

Wells Fargo Phone

- Bank 1-800-TO-WELLS (1-800-869-3557)

- Spanish-speaking customers 1-877-PARA-WFB (1-877-727-2932)

- Chinese-speaking customers 1-800-288-2288

- TTY/TDD for deaf and hard-of-hearing customers 1-800-877-4833

Wells Fargo Mobile

- Visit wellsfargo.com or call 1-866-863-6762

Bottom Line

Wells Fargo is a major bank with 6,000 physical branch locations and 13,000 ATMs and has a long history of being one of the top banks in the United States. Savings accounts are certainly a good way to grow your money and to attain your financial goals. The Wells Fargo Way2Save Savings account doesn’t offer the highest interest rate, but it allows you to save money faster by setting up automatic transfers to contribute to your savings account. This is a good option for anyone who already banks with Wells Fargo or anyone who is looking to make the switch to Wells Fargo for their financial needs.

Banking Health Score

There are many banks and financial institutions to choose from and it is important to be able to distinguish the good from the bad. Our team reviews each bank on a monthly basis to ensure that the information we share is as up to date as possible. Not only is the financial strength of a company important, but also how well their customer service is rated by actual customers like you.

We also believe that in order to determine how well a bank is functioning, that several sources should be utilized to compare one bank to another.

That said, here is a list of scores from trusted sources that you should consider before making your banking decisions.

Wells Fargo – Bank Health Scores

Bank Professor’s Bank Score = ⭐⭐⭐ 3 stars out of 5 stars

Additional Scores

- Bankrate’s Safe and Sound Rating: 2.5 out of 5 stars

- BauerFinancial Star Rating: 4 out of 5 stars

- BankTracker Troubled Asset Ratio: 4.55

- FDIC: Actively insured

More about the rating system:

- BankProfessor rates banks monthly on a one-to-five scale based on revenue, net income, total assets, total equity, capital ratio, customer reviews, rating agency scores, profitability, and troubled asset ratio.

- Bankrate.com ranks banks and credit unions quarterly on a one- to five-star system, with one being the lowest rating and five the highest. The rating is given based on regulatory filings about the financial institution’s capital adequacy, asset quality, profitability and level of cash available. It compares those levels with peer and industry norms.

- BauerFinancial offers a similar star rating system as Bankrate (a one- to five-star system, with one being the lowest rating and five the highest).

- BankTracker was created by the Investigative Reporting Workshop of American University and MSNBC.com. They determine a bank’s troubled asset ratio. According to the site, the ratio is “a strong indicator of severe stress inside a bank because it shows the bank’s ability to withstand loan losses”. In other words, the higher the ratio, the more “trouble” they are in...

How to Close a Wells Fargo Account

If you wish to close your account with Wells Fargo, you will first need to make sure that all pending transactions have cleared before you start transferring any money out of the account. Then, you can either visit a branch in person or contact the bank at 1-800-869-3557.

If you live outside of the U.S. account closure requests will need to be made in writing (even if you call first) by filling out this Wells Fargo Account Closure Request Form and submitting by mail. Just be prepared – you will need to have the form notarized before you can submit it to Wells Fargo.

Once the form has been submitted, should receive a response or confirmation of account closure within a few business days.